Goaltide Daily Current Affairs 2024

Current Affair 1:

Regulatory Sandbox scheme

News:

The Regulatory Sandbox usually refers to live testing of new products or services in a controlled/test regulatory environment.

The RS allows the regulator, the innovators, the financial service providers (as potential deployers of the technology) and the customers (as final users) to conduct field tests to collect evidence on the benefits and risks of new financial innovations, while carefully monitoring and containing their risks.

Regulatory Sandbox: Benefits

The setting up of an RS can bring several benefits:

-

First and foremost, the RS fosters ‘learning by doing’ on all sides. Regulators obtain first-hand empirical evidence on the benefits and risks of emerging technologies and their implications, enabling them to take a considered view on the regulatory changes or new regulations that may be needed to support useful innovation, while containing the attendant risks.

-

Second, users of an RS can test the product’s viability without the need for a larger and more expensive roll-out, if the product appears to have the potential to be successful.

-

Third, FinTech provide solutions that can further financial inclusion in a significant way. The RS can go a long way in not only improving the pace of innovation and technology absorption but also in financial inclusion and in improving financial reach.

-

Fourth, by providing a structured and institutionalized environment for evidence- based regulatory decision-making, the dependence of the regulator on industry/stakeholder consultations only is correspondingly reduced.

-

Fifth, the RS could lead to better outcomes for consumers through an increased range of products and services, reduced costs and improved access to financial services.

Regulatory Sandbox: Eligibility Criteria

The target applicants for entry to the RS, are FinTech companies including start-ups, banks, financial institutions, any other company, Limited Liability Partnership (LLP) and partnership firms, partnering with or providing support to financial services businesses, subject to the sandbox criteria laid down in these guidelines.

Current Affair 2:

About SWAYAM Plus

News:

Current Affair 3:

Pey Jal Survekshan Awards

News:

Pey Jal Survekshan (PJS), as part of AMRUT 2.0 mission, aims to evaluate the service level achievements in the quality, quantity, and coverage of water supply; sewerage and septage management; the extent of reusing and recycling of wastewater and the conservation of water bodies within the city.

Pey Jal Survekshan Awards to be conferred by President of India Smt Droupadi Murmu on 5th March, 2024.

Current Affair 4:

SAMAR Assessment Certificates

News: The DRDO handed over SAMAR (System for Advance Manufacturing Assessment and Rating) assessment certificates to nine Industry Partners.

System for Advance Manufacturing Assessment and Rating (SAMAR) is a benchmark to measure the maturity of defence manufacturing enterprises.

SAMAR is an outcome of the collaboration between DRDO and QCI to strengthen the defence manufacturing ecosystem in the country with an objective to further the vision of making India self- reliant in defence manufacturing.

The certification is based on a maturity assessment model developed by QCI and is applicable to all defence manufacturing enterprises i.e., micro, small, medium and large enterprises.

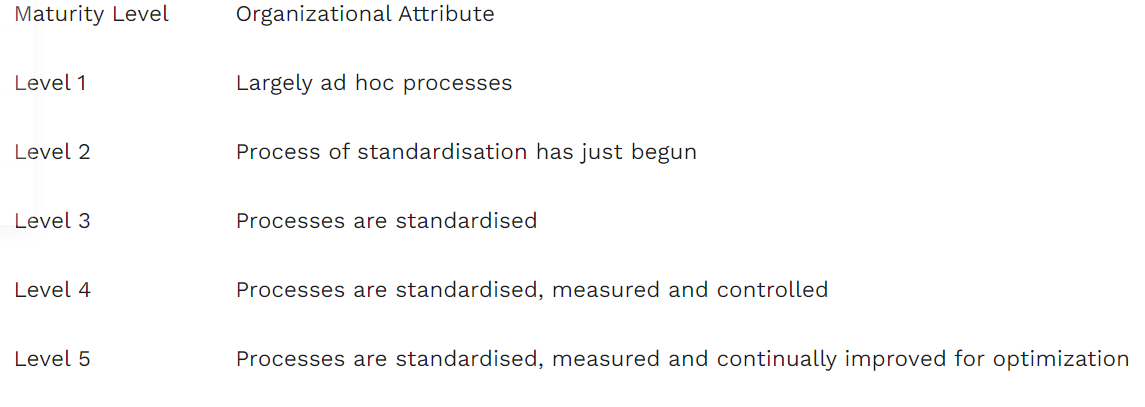

SAMAR Certification framework recognizes 5 levels of enterprise maturity in terms of the defined organizational attributes:

All defence manufacturing enterprises, both MSME and Large enterprises, are eligible to apply for System for Advance Manufacturing Assessment and Rating (SAMAR) certification.

The SAMAR certification is valid for a period of 2 years from the date of issuance of certificate.

<< Previous Next >>